CORRESP: A correspondence can be sent as a document with another submission type or can be sent as a separate submission.

Published on September 21, 2022

September 21, 2022

Via EDGAR

Securities and Exchange Commission

Division of Corporation Finance

Office of Technology

100 F. Street, N.E.

Washington, D.C. 20549

| Attn: | Claire DeLabar, Senior Staff Accountant |

| Robert Littlepage, Accountant Branch Chief |

| Re: | Evolv Technologies Holdings, Inc. |

| Form 10-K for the Fiscal Year Ended December 31, 2021, Filed March 28, 2022 | |

| Form 10-Q for the Period Ended June 30, 2022, Filed August 18, 2022 | |

| File No. 001-39417 |

To the addressees set forth above:

This letter sets forth the response of Evolv Technologies Holdings, Inc. (the “Company,” “Evolv,” “we,” “our” and “us”) to the comment provided by the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) in its comment letter dated September 7, 2022 (the “Comment Letter”) with respect to the Company’s Form 10-K for the Fiscal Year Ended December 31, 2021 (the “Form 10-K”) filed with the Commission on March 28, 2022 and the Company’s Form 10-Q for the Period Ended June 30, 2022 filed with the Commission on August 18, 2022 (the “Form 10-Q”).

For your convenience, we have reproduced the comment of the Staff exactly as given in the Comment Letter in bold and italics below and set forth below the comment the Company’s response.

Form 10-Q for the Period Ended June 30, 2022 filed August 18, 2022

Financial Statements

Note 1. Nature of the Business and Basis of Presentation

Revision of Prior Period Financial Statements, page F-6

| 1. | Refer to your conclusion on pages F-6 and page 1 of MD&A that the errors you identified and their related impacts were not material. We note that the adjustments to the audited statements of cash flows for the year ended December 31, 2021 in Note 21 on page F-38 appear to be significant to cash flows from operating activities and cash flows from investing activities. We also note that you included the June 30, 2022 disclosures in your Form 424B3 filed August 18, 2022. Please provide us a detailed analysis that supports your conclusion that the identified errors are not material to all of the periods presented, and in particular to your audited financial statements included in the most recent Form 424B3 in light of the above. |

Response:

The Company respectfully acknowledges the Staff’s comment and advises the Staff that it has evaluated the errors in accordance with Accounting Standard Codification 250, Accounting Changes and Error Corrections (“ASC 250”) and SEC Staff Accounting Bulletin (“SAB”) Topics 1.M and 1.N (formerly referred to as SAB Nos. 99 and 108, respectively). The Company evaluated the errors both individually and in the aggregate, and considered both quantitative and qualitative factors to evaluate whether the errors were material to the Company’s financial statements taken as a whole.

Background

In preparing its financial statements for the quarter ended June 30, 2022, the Company identified errors in its previously issued financial statements. As discussed in more detail below, several factors led to the identification of these errors, including the hiring of additional personnel and the implementation of a new enterprise resource planning (“ERP”) system. The errors identified by the Company were as follows:

| ● | Certain equipment under lease or held for lease was inaccurately classified as inventory on the consolidated balance sheets, and the cash outflows related to the equipment under lease or held for lease were misclassified as operating cash outflows on the consolidated statements of cash flows. |

For context, the Company either sells or leases its equipment to customers (lease transactions are primarily under operating lease-type arrangements). Equipment leased or held for lease is classified as a long-lived asset (PP&E) on the balance sheet and equipment to be sold to customers is classified as inventory. As it pertains to the statement of cash flows, the Company’s policy under ASC 230, Statement of Cash Flows, is that cash payments for equipment leased or to be leased are classified as investing cash outflows and cash payments for equipment to be sold are classified as operating cash outflows.

Prior to the quarter ended September 30, 2021, the Company was classifying cash payments for equipment that was leased during the quarter as investing cash outflows and the remaining cash payments for equipment as operating cash outflows. In connection with the preparation of its financial statements for the quarter ended June 30, 2022, the Company determined that for the nine months ended September 30, 2021, the year ended December 31, 2021, and the three ended March 31, 2022, all cash payments for equipment were reported as operating cash outflows and equipment that was leased in the quarter was disclosed as a non-cash investing activity described as “transfer of inventory to property and equipment.”

This resulted in a classification error as certain of the cash payments should have been classified as investing activities, as had been done prior to the quarter ended September 30, 2021. Additionally, the Company identified other minor errors in the calculation of the split between operating and investing activities for these equipment-related cash payments, as well as balance sheet classification errors between inventory and PP&E.

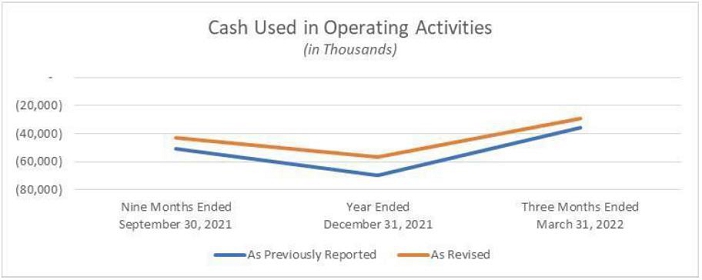

The statement of cash flows misclassification had the effect of overstating the total cash outflow from operating activities by $7.9 million, $12.8 million and $6.4 million, or 19%, 23%, and 22% for the nine months ended September 30, 2021, for the year ended December 31, 2021 and for the three months ended March 31, 2022, respectively.

|

2 |

| ● | Certain cost of subscription revenue related expenses and cost of service revenue related expenses were inaccurately classified as sales and marketing expenses on the consolidated statements of operations and comprehensive income (loss). These expenses related primarily to field service costs, product installation, and customer support, which are services the Company provides pursuant to its subscription and service contracts with customers. This error was a classification error within the consolidated statements of operations and comprehensive income (loss) and did not have any impact on operating income (loss) or net income (loss) for any period. |

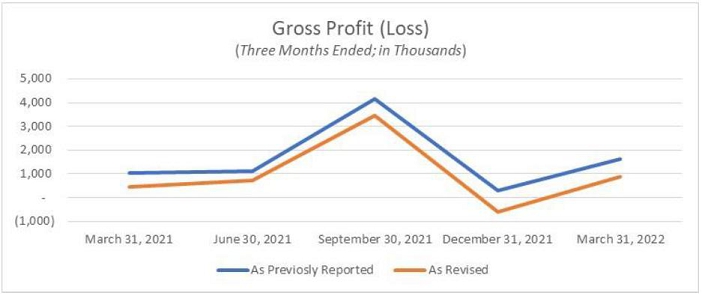

This error had the effect of overstating sales and marketing expense, understating cost of sales and overstating gross profit by $0.3 million, $0.5 million, $0.8 million, $1.0 million and $1.0 million for the three months ended March 31, 2021, June 30, 2021, September 30, 2021, December 31, 2021 and March 31, 2022, respectively, and $2.6 million for the year ended December 31, 2021.

| ● | The vesting of warrants related to the Business Development Agreement with Finback Evolv OBH, LLC (“Finback”) was not accounted for appropriately. Under the Business Development Agreement, Finback vests in warrants of the Company’s public stock for each “lead” or “assist” they provide that results in the sale of the Company’s product to a customer. Due to an internal control deficiency related to the tracking of Finback’s participation in the generation of sales leads and assists, the Company did not recognize expense, or recognized expense in the incorrect period, related to the vesting of warrants for certain sales contracts whereby Finback served in a lead or assist capacity. |

This error had the effect of understating sales and marketing expense by $0.9 million and $0.1 million for the years ended December 31, 2020 and 2021, respectively. In relation to the quarterly periods within the year ended December 31, 2021, the error had the effect of understating (overstating) sales and marketing expense by ($0.8) million, $0.5 million, $1.0 million and ($0.6) million for the quarters ended March 31, 2021, June 30, 2021, September 30, 2021 and December 31, 2021, respectively. The impact of the error to the quarter ended March 31, 2022 was an overstatement of sales and marketing expense of $0.2 million.

The identified errors impacted the Company's previously issued financial statements for the years ended December 31, 2020 and 2021 and the quarters ended March 31, 2021, June 30, 2021, September 30, 2021, and March 31, 2022. In order to enhance comparability of its financial statements, the Company revised its prior period financial statements to correct the foregoing errors and included a revision footnote in its financial statements included in its Form 10-Q for the quarter ended June 30, 2022. Additionally, as part of the revision, the Company made adjustments to correct for all previously identified immaterial errors (for example, as previously disclosed in its Form 10-Q for the quarter ended March 31, 2022, the Company had recorded immaterial out-of-period adjustments in its consolidated statement of operations for the three months ended March 31, 2022 and as part of the revision, made adjustments to correct those errors in the proper prior periods).

Several factors led to the identification of the aforementioned errors. In response to the previously identified material weaknesses, the Company recently hired additional accounting and internal audit personnel to enhance its technical accounting, financial reporting, and internal control capabilities and expertise. As a result of these hirings, the Company put in place new controls and procedures, and enhanced existing controls and procedures, related to the review of financial statement presentation and disclosure (including the cash flow statement), the approval of journal entries, and the documentation and analysis of technical accounting matters. Further, the Company implemented a new ERP system during the quarter ended June 30, 2022. While mapping the account and entity structures between the old ERP and new ERP, the Company reviewed its accounting for certain general ledger accounts and departments which, for example, resulted in the identification of the misclassification of expense between cost of sales and sales and marketing expense, as described in the second bullet point above.

|

3 |

Analysis

In performing its analysis of the identified errors, the Company also referenced the statement released on March 9, 2022 by Paul Munter, Acting Chief Accountant of the SEC, entitled “Assessing Materiality: Focusing on the Reasonable Investor When Evaluating Errors.” Accordingly, when considering the materiality of the errors, management completed a holistic and objective assessment to determine whether there is a substantial likelihood that the errors would be important to a reasonable investor by significantly altering the total mix of information available. In addition, management considered the relative importance of the impacted financial measures given the Company’s stage and strategy, the key metrics considered by the Company’s analysts and investors, and the impact on reported trends of financial results.

Evolv is an early stage technology company with revenue (as revised) of $5.4 million for the year ended December 31, 2020 and $23.4 million for the year ended December 31, 2021. Management is focused on certain metrics that align with the Company’s revenue growth strategy and business model. The Company internally tracks and externally reports certain growth-related metrics, including annual recurring revenue, new customer growth, remaining performance obligations, and total contract value. The Company is currently covered by sell-side analysts at four investment firms: Stifel, Cowen, Imperial Capital and Northland Capital Markets (the Company’s “Analysts”) and has a number of large institutional investors (the Company’s “Investors”). The Company’s discussions with its Analysts and Investors, as well as commentary within the reports issued periodically by the Analysts, are heavily focused on revenue and growth-related metrics. While the Analysts do report out and provide commentary on metrics such as gross margin, EBITDA, and EPS, each Analyst uses Enterprise Value-to-Revenue as their primary valuation method, as opposed to cash flow multiples or earnings-based multiples. Further, the Company has maintained a very strong cash position since becoming a public company in mid-2021. Accordingly, the Analysts provide commentary in their reports on the Company’s overall liquidity and “cash burn” as opposed to the specific nature or classification of the Company’s cash flows, and the Company receives very few questions and clarification requests from its Analysts and Investors regarding the Company’s cash flow statement or profitability in general.

The following chart sets forth the impact of the errors that were revised for on selected financial statement line items of the Company’s audited financial statements as of and for the years ended December 31, 2021 and 2020 and the unaudited quarterly financial statements for the three months ended March 31, 2021, the three and six months ended June 30, 2021, the three and nine months ended September 30, 2021, the three months ended December 31, 2021 (as derived), and the three months ended March 31, 2022:

|

4 |

| As of and for the Year Ended December 31, 2020 | ||||||||||||

| (in thousands, except per share information) | As Previously Reported |

Adjustments | As Revised | |||||||||

| Balance Sheet | ||||||||||||

| Current Assets | $ | 10,309 | $ | (515 | ) | $ | 9,794 | |||||

| Long-Term Assets | 11,046 | 925 | 11,971 | |||||||||

| Total Assets | 21,355 | 410 | 21,765 | |||||||||

| Current Liabilities | 12,119 | 529 | 12,648 | |||||||||

| Long-Term Liabilities | 18,045 | - | 18,045 | |||||||||

| Total Liabilities | 30,164 | 529 | 30,693 | |||||||||

| Equity & Convertible Preferred Stock | (8,809 | ) | (119 | ) | (8,928 | ) | ||||||

| Statement of Operations | ||||||||||||

| Revenue | 4,785 | 596 | 5,381 | |||||||||

| Gross Profit | 1,289 | 33 | 1,322 | |||||||||

| Operating loss | (26,896 | ) | (1,149 | ) | (28,045 | ) | ||||||

| Net loss | (27,392 | ) | (1,035 | ) | (28,427 | ) | ||||||

| Earnings per share, basic and diluted | (3.07 | ) | (0.11 | ) | (3.18 | ) | ||||||

| Statement of Cash Flows | ||||||||||||

| Operating Activities | (23,254 | ) | (348 | ) | (23,602 | ) | ||||||

| Investing Activities | (6,609 | ) | 348 | (6,261 | ) | |||||||

| Financing Activities | 17,226 | - | 17,226 | |||||||||

| As of and for the Year Ended December 31, 2021 | ||||||||||||

| (in thousands, except per share information) | As Previously Reported |

Adjustments | As Revised | |||||||||

| Balance Sheet | ||||||||||||

| Current Assets | $ | 333,660 | $ | (2,540 | ) | $ | 331,120 | |||||

| Long-Term Assets | 29,405 | 2,332 | 31,737 | |||||||||

| Total Assets | 363,065 | (208 | ) | 362,857 | ||||||||

| Current Liabilities | 24,371 | (41 | ) | 24,330 | ||||||||

| Long-Term Liabilities | 47,856 | 397 | 48,253 | |||||||||

| Total Liabilities | 72,227 | 356 | 72,583 | |||||||||

| Equity | 290,838 | (564 | ) | 290,274 | ||||||||

| Statement of Operations | ||||||||||||

| Revenue | 23,692 | (299 | ) | 23,393 | ||||||||

| Gross Profit | 6,641 | (2,612 | ) | 4,029 | ||||||||

| Operating loss | (54,061 | ) | (1,205 | ) | (55,266 | ) | ||||||

| Net loss | (10,858 | ) | (30 | ) | (10,888 | ) | ||||||

| Earnings per share, basic and diluted | (0.15 | ) | (0.00 | ) | (0.15 | ) | ||||||

| Statement of Cash Flows | ||||||||||||

| Operating Activities | (69,628 | ) | 12,847 | (56,781 | ) | |||||||

| Investing Activities | (4,738 | ) | (12,847 | ) | (17,585 | ) | ||||||

| Financing Activities | 377,829 | - | 377,829 | |||||||||

|

5 |

| Three Months ended March 31, 2021 | ||||||||||||

| (in thousands, except per share information) | As Previously Reported |

Adjustments | As Revised | |||||||||

| Statement of Operations | ||||||||||||

| Revenue | $ | 3,999 | $ | (306 | ) | $ | 3,693 | |||||

| Gross Profit | 1,048 | (599 | ) | 449 | ||||||||

| Operating loss | (9,147 | ) | 196 | (8,951 | ) | |||||||

| Net loss | (13,755 | ) | 249 | (13,506 | ) | |||||||

| Earnings per share, basic and diluted | (1.32 | ) | 0.03 | (1.29 | ) | |||||||

| Statement of Cash Flows | ||||||||||||

| Operating Activities | (12,038 | ) | (401 | ) | (12,439 | ) | ||||||

| Investing Activities | (2,522 | ) | 401 | (2,121 | ) | |||||||

| Financing Activities | 31,978 | - | 31,978 | |||||||||

| Three Months ended June 30, 2021 (Statement of Operations) and Six Months Ended June 30, 2021 (Statement of Cash Flows) |

||||||||||||

| (in thousands, except per share information) | As Previously Reported |

Adjustments | As Revised | |||||||||

| Statement of Operations | ||||||||||||

| Revenue | $ | 4,480 | $ | 198 | $ | 4,678 | ||||||

| Gross Profit | 1,131 | (403 | ) | 728 | ||||||||

| Operating Loss | (6,316 | ) | (598 | ) | (6,914 | ) | ||||||

| Net loss | (22,371 | ) | (606 | ) | (22,977 | ) | ||||||

| Earnings per share, basic and diluted | (1.88 | ) | (0.05 | ) | (1.93 | ) | ||||||

| Statement of Cash Flows | ||||||||||||

| Operating Activities | (16,954 | ) | (1,338 | ) | (18,292 | ) | ||||||

| Investing Activities | (9,292 | ) | 1,338 | (7,954 | ) | |||||||

| Financing Activities | 32,180 | - | 32,180 | |||||||||

|

6 |

| Three Months ended September 30, 2021 (Statement of Operations) and Nine Months Ended September 30, 2021 (Statement of Cash Flows) |

||||||||||||

| (in thousands, except per share information) | As Previously Reported |

Adjustments | As Revised | |||||||||

| Statement of Operations | ||||||||||||

| Revenue | $ | 8,367 | $ | 57 | $ | 8,424 | ||||||

| Gross Profit | 4,156 | (689 | ) | 3,467 | ||||||||

| Operating Loss | (16,634 | ) | (2,726 | ) | (19,360 | ) | ||||||

| Net Income | 22,751 | (1,944 | ) | 20,807 | ||||||||

| Earnings per share, basic | 0.19 | (0.02 | ) | 0.17 | ||||||||

| Earnings per share, diluted | 0.15 | (0.01 | ) | 0.14 | ||||||||

| Statement of Cash Flows | ||||||||||||

| Operating Activities | (50,477 | ) | 7,912 | (42,565 | ) | |||||||

| Investing Activities | (3,082 | ) | (7,912 | ) | (10,994 | ) | ||||||

| Financing Activities | 383,277 | - | 383,277 | |||||||||

| Three Months ended December 31, 2021 | ||||||||||||

| (in thousands, except per share information) | As Previously Reported |

Adjustments | As Revised | |||||||||

| Statement of Operations | ||||||||||||

| Revenue | 6,846 | (248 | ) | 6,598 | ||||||||

| Gross Profit (Loss) | 306 | (921 | ) | (615 | ) | |||||||

| Operating Loss | (21,964 | ) | 1,923 | (20,041 | ) | |||||||

| Net Income | 2,517 | 2,271 | 4,788 | |||||||||

| Three Months ended March 31, 2022 | ||||||||||||

| (in thousands, except per share information) | As Previously Reported |

Adjustments | As Revised | |||||||||

| Statement of Operations | ||||||||||||

| Revenue | $ | 8,715 | $ | (5 | ) | $ | 8,710 | |||||

| Gross Profit | 1,626 | (729 | ) | 897 | ||||||||

| Operating Loss | (25,902 | ) | 2,039 | (23,863 | ) | |||||||

| Net Loss | (14,551 | ) | 750 | (13,801 | ) | |||||||

| Earnings per share, basic and diluted | (0.10 | ) | - | (0.10 | ) | |||||||

| Statement of Cash Flows | ||||||||||||

| Operating Activities | (35,867 | ) | 6,437 | (29,430 | ) | |||||||

| Investing Activities | (969 | ) | (6,448 | ) | (7,417 | ) | ||||||

| Financing Activities | 216 | 11 | 227 | |||||||||

|

7 |

As outlined in the tables above, the most quantitatively significant error that was identified related to the statement of cash flows. The main driver of the misclassification between operating activities and investing activities is the inaccurate classification of cash payments for equipment leased or held for lease as operating cash outflows for the nine months ended September 30, 2021, the year ended December 31, 2021 and the three months ended March 31, 2022. While the cash payments were misclassified for each of these periods, the Company considered in its analysis that it disclosed the amount of transfers of inventory to property and equipment within the supplemental disclosure of non-cash activities on the statement of cash flows. For example, in the statement of cash flows for the year ended December 31, 2021, the Company disclosed non-cash transfers of inventory to property and equipment of $12.9 million, which is materially consistent with the misclassification between operating and investing cash flows for that period of $12.8 million as set forth in the table above. Based on the totality of the information that was included on the statement of cash flows, the Company believes that a reader of its financial statements would understand that the cash flows associated with purchases of equipment to be leased were flowing through operating activities and could also ascertain the approximate magnitude of such purchases. Notably, the corrections of the misclassifications had the effect of decreasing the total cash outflow from operating activities for each of the three periods indicated versus what was previously reported. Further, management considered whether the errors materially impacted the trending of operating cash flows. As can be seen below, the “As Previously Reported” and “As Revised” amounts follow very similar trendlines:

Further, while a required GAAP measure, the Company does not believe operating cash flows are currently a key metric for the Analysts and Investors, as discussed in further detail above. Specifically, based on questions and clarification requests the Company typically receives from the Analysts and Investors, the Analysts and Investors are primarily focused on the Company’s overall liquidity position and cash burn rate, as opposed to the classification of its cash flows. Furthermore, the Company does not report free cash flow or any other non-GAAP liquidity measure, nor considers such measures to be key. Based on guidance provided by the Company, the Company believes the Analysts and Investors expect significant cash outflows at this stage in the Company’s expansion as the Company purchases equipment to be used in leases of equipment and sale of equipment to customers.

In light of the errors in the statement of cash flows, the Company also considered the impact to its internal control over financial reporting, and updated the disclosures of its Material Weaknesses in Internal Control over Financial Reporting in its Form 10-Q for the period ended June 30, 2022, as follows: “We did not design and maintain effective controls over the period-end financial reporting process to achieve complete, accurate and timely financing accounting, reporting and disclosures, including the classification of various accounts in the consolidated financial statements and the presentation and disclosure of items in the consolidated statements of cash flows” (emphasis added). A conforming update was made to the Company’s risk factors disclosure related to its material weaknesses.

|

8 |

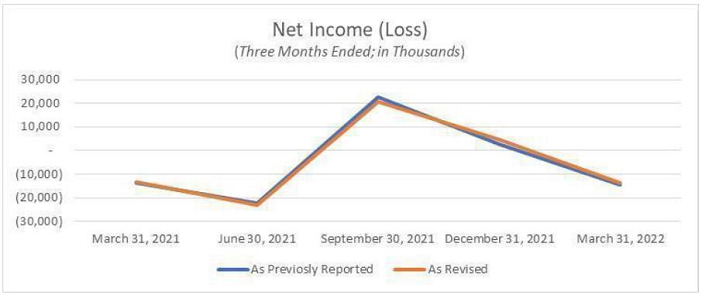

The second error identified within “Background” above related to the misclassification of certain amounts between cost of sales and sales and marketing expense which impacted gross profit but did not impact operating income (loss) or net income (loss). The third error identified above related to the inaccurate accounting for the vesting of warrants issued to Finback impacted operating income (loss) and net income (loss) but did not impact gross profit. The other previously identified immaterial errors discussed within “Background” above impacted various financial statement line items including, in some instances, gross profit, operating income (loss), and net income (loss). As noted above and as evidenced by the Company’s interactions with the Analysts and Investors and review of analyst reports, the Analysts primarily focus on revenue and growth-related metrics. While the Company acknowledges the Analysts do report gross margin in their reports, it is the Company’s understanding, based on interactions with the Analysts, that the Analysts do not consider gross margin to be one of the key indicators of performance or overall value of the Company given the historical fluctuations in gross margin due to the early stage in the Company’s development. The Company also communicated in its earnings call for the quarter ended June 30, 2022 that its gross margins do not currently reflect the Company’s overall business value given that the Company’s sales have skewed towards purchase subscriptions, which generally result in lower margins earlier in the contract lifecycle compared to pure subscription contracts. Going forward, the Company expects to lead increasingly with its pure subscription offering. Further, the Company was in an operating loss position for each prior period impacted by the errors, which is consistent with the Company’s current lifecycle. Additionally, while the errors had the effect of decreasing net income for the three months ended September 30, 2021 by $1.9 million and increasing net income for the three months ended December 31, 2021 by $2.3 million, total net loss for the year ended December 31, 2021 was misstated by less than $0.1 million.

The following tables illustrate the trending of gross profit (loss) and net income for each quarterly period beginning with the three months ended March 31, 2021. The variance between the “As reported” and “As Revised” gross profit (loss) amounts is primarily related to the misclassification of field services costs, which had a similar relative impact on gross profit for each period but had no impact on net income. The Company does not believe the errors mask a change in trend for either gross profit (loss) or net income.

|

9 |

Finally, the Company considered the impact of the errors on revenue given that revenue is a key metric for both management and the Analysts and Investors. Revenue was not misstated in any annual period by more than $0.6 million or in any fiscal quarter by more than $0.3 million. The Company considers these amounts to be immaterial. Further, as evidenced by the chart below, the trending of revenue was not materially impacted by the errors.

|

10 |

Below are additional qualitative factors management assessed, in accordance with SAB Topic 1.M:

| ● | Whether the misstatement arises from an item capable of precise measurement or whether it arises from an estimate |

The three primary errors identified in “Background” above relate to items capable of precise measurement, with the exception of certain estimates necessary to allocate finished goods between inventory (related to an estimate of finished goods to be sold) and property and equipment (related to an estimate of finished goods to be leased).

| ● | Whether the misstatement masks a change in earnings or other trends |

The errors do not mask a change in any earnings or other trends. See the charts and related corresponding discussion above that present the trending of cash used in operating activities, gross profit (loss), and net income (loss).

| ● | Whether the misstatement hides a failure to meet analysts’ consensus expectations for the enterprise |

The errors did not materially impact the metrics or expectations of those metrics that the Company believes, based on its review of analyst reports and interactions with the Analysts and Investors, are key to the Analysts and Investors given the stage of the Company. The Company did not see any indications that its stock price was negatively impacted by disclosure of the errors, and the Company did not receive substantive inquiries regarding the errors by the Analysts or Investors.

| ● | Whether the misstatement changes a loss into income or vice versa |

There was no change from net loss or operating loss to net income or operating income, or vice versa, in any given period.

|

11 |

| ● | Whether the misstatement concerns a segment or other portion of the registrant’s business that has been identified as playing a significant role in the registrant’s operations or profitability |

The Company has only one operating and reportable segment.

| ● | Whether the misstatement affects the registrant’s compliance with regulatory requirements, loan covenants, or other contractual requirements |

The errors do not impact the Company’s compliance with regulatory requirements, loan covenants, or other contractual requirements.

| ● | Whether the misstatement has the effect of increasing management’s compensation |

The errors did not have the effect of increasing management’s compensation for any period.

| ● | Whether the misstatement involves concealment of an unlawful transaction |

The errors did not involve the concealment of any unlawful or illegal transactions in any of the prior periods.

|

12 |

Conclusion

Based on a holistic analysis considering the quantitative and qualitative factors discussed above and taking into consideration the total mix of information available to a reasonable investor as set forth, among others, in the Company’s filings with the Commission, management and the audit committee of the Company’s board of directors concluded that the identified errors are not material to any of the previously issued financial statements and that those financial statements can still be relied upon. Additionally, related specifically to the errors in the statements of cash flows, the Company reiterates (i) its belief that a reader of its financial statements would be able to understand the nature and magnitude of the incorrectly reported transactions given the availability of relevant, decision-useful information about cash payments for inventory that were ultimately used for investing activities (used for leasing) but were reported as operating activities, (ii) as noted above, based on its interactions with the Analysts and Investors, the Company believes that the Analysts and Investors are generally not focused on activity-based liquidity measures (such as operating or investing cash flows and free cash flow) given the current stage of the Company, and (iii) the errors did not impact any trends in reported operating cash flows.

While the Company concluded the errors were not material, management and the audit committee determined that a revision of the prior period financial statements would enhance the comparability of the Company’s financial results and would therefore be beneficial to the Company’s stakeholders and investors. Accordingly, the Company revised the prior period comparative amounts presented in the financial statements included in its Form 10-Q for the quarter ended June 30, 2022 and included a revision footnote that discloses the impact of the errors by bridging the “As Previously Reported” and “As revised” amounts for the annual periods ended December 31, 2021 and 2020, the three and nine month periods ended September 30, 2021, the three and six month periods ended June 30, 2021, the three month period ended March 31, 2021 and the three month period ended March 31, 2022. Furthermore, the Company updated its disclosure of its existing material weaknesses to disclose that the material weaknesses include a control deficiency related to the statement of cash flows.

Based on the previously discussed quantitative and qualitative factors, management believes the magnitude of these changes indicates that the identified errors are not material to any period presented and therefore do not require restatement of any of the Company’s consolidated historical financial statements. The Company disclosed the revised prior period amounts in its Form 10-Q for the quarter ended June 30, 2022 and will continue to present the revised amounts in its future filings.

* * * *

|

13 |

If you have any questions or further comments about this response, please contact me by email at mdonohue@evolvtechnology.com or by phone at 781-374-8100.

| Sincerely, | ||

| Evolv Technologies Holdings, Inc. | ||

| By: | /s/ Mark Donohue | |

| Name: | Mark Donohue | |

| Title: | Chief Financial Officer | |

| Cc: | Ryan J. Maierson, Latham & Watkins LLP |

| Stephen Ranere, Latham & Watkins LLP | |

| Erika Weinberg, Latham & Watkins LLP | |

| Irina Yevmenenko, Latham & Watkins, LLP |

|

14 |